New Washington import moves, changing consumer spending patterns, increased industry savvy should help US textiles, apparel survive in the current economic climate.

Robert S. Reichard, Economics Editor

I t's been another disappointing year for the hard-pressed textile and apparel industries. Most of the woes, however, can be traced back to a sagging economy rather than to further market inroads by China and other cheap overseas competitors.

I t's been another disappointing year for the hard-pressed textile and apparel industries. Most of the woes, however, can be traced back to a sagging economy rather than to further market inroads by China and other cheap overseas competitors. No dramatic near-term turnaround is anticipated, primarily because it will take lots of time for new US fiscal and financial moves to turn the economy around. Gross domestic product should remain in negative territory for a few more quarters, with unemployment jumping to 8 percent or higher.

But things should begin to pick up after that as the economy slowly begins to recover. However, significant gains at that time will be hard to come by, and won't be nearly enough to prevent other sizeable slippage in overall textile and apparel activity.

On a rosier note, several other factors will be working for industry improvement, including: new Washington moves to control imports; a change in spending patterns with big-ticket items like cars being cut back, thus leaving more money available for apparel and home-furnishing purchases; and an increasingly effective and savvy domestic industry. This point can't be underestimated. Such strategies as more new product introductions, improved global sourcing, better cost containment, ongoing investment in ever-more-efficient equipment and better industry/government cooperation should pretty much guarantee industry survival.

All the above is not meant to suggest the industry is home free. For one, China and other exporters will be more determined than ever to keep their textile and garment factories busy by trying to funnel more goods into the American market.

Example: China apparently has ended its policy of letting its currency, the yuan, continue to rise. This means Chinese prices to US buyers will remain relatively low. And Beijing recently increased its tax rebates to exporters, something that should give its producers a further price advantage over their US counterparts.

Finally, the remaining textile and apparel safeguards on Chinese exports have just expired, and it's not clear how effective newly proposed protective moves will be.

Bottom line: Calling the tune on 2009 isn't all that easy. Lingering question marks and uncertainties make precision forecasting a lot more iffy. And clearly, there's the likelihood of a somewhat bigger-than-normal margin of error.

Nevertheless, Textile World editors still feel a meaningful assessment of what lies about for 2009 is possible. Assuming a few more negative quarters followed by slow economic recovery toward year-end, combined domestic textile and apparel activity for 2009 should decline about 5 to 6 percent, somewhat under the 8- to 9-percent drop-off of the past year.

Looking At Demand

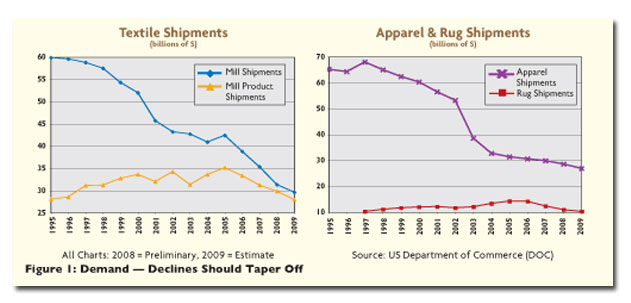

This basic pattern of somewhat smaller declines should apply to most key industry segments. Shipments of basic mill products, such as yarns and fabrics, are projected to fall about 4 to 5 percent to $29 billion to $30 billion.

The outlook for more highly fabricated mill products, such as carpets and home furnishings, could be a bit more bearish, primarily because the housing meltdown will cut sharply into carpet purchases. TW estimates shipments of just under $28 billion, off about 6 percent from 2008 levels.

For carpets alone, the downtrend could be even steeper, with 2009 shipments not expected to rise much above $10.3 billion - a big 8-percent decline from 2008 and a far cry from the $14.3 billion peak hit in 2005.

Meantime, one upbeat sign about the overall fabricated mill product category: The sector has dropped only about 15.5 percent over the extended 2002-2008 period. That's less than half the 36-percent drop in basic mill items over the same period (See Figure 1).

Finally, US domestic apparel shipments for 2009 are expected to fall another 6 percent or so to near $26.9 billion. But that's not too bad when compared to the huge declines in autos or other big-ticket products currently anticipated for the current year.

Also, beyond 2009, these declines will shrink substantially. At least that's what the latest forecasts from Global Insight, a major economic firm, seem to suggest. Their analysts also back up TW 's feeling that economic conditions will be a lot better after 2009. In any event, their 2010-2011 projections for basic mill products and fabricated mill products call for average annual declines of only 3 percent and 3.5 percent, respectively - a far slower shrinkage rate than noted over the past few years.

No Real Cost Pressure

Another relatively encouraging sign for the US textile and apparel industries is their continuing ability to hold costs down. Indeed, over the past year, aggregate costs, after adjusting for reduced volume, actually showed little significant change.

The latest numbers from Global Insight suggest much the same for the new year. Analysts at the consulting firm put overall textile and apparel material outlays - again adjusted for volume - fairly close to 2008 levels. Behind these estimates: a combination of more than ample supplies and still sluggish demand.

Looking at cotton, prices have dropped from a high of 60 cents per pound over the past year to only around 40 cents per pound at last report. And there's little to suggest any change. The US Department of Agriculture (USDA) sees a 3-percent drop in global use for the year ending July 2009. Combined with fairly robust 2008 harvests, this translates into a more-than-needed supply. Indeed, according to USDA officials, the consumption/availability ratio will jump by the end of the 2008-09 marketing season both domestically and globally - a scenario that would seem to rule out any new price run-up.

And a similar picture seems to be shaping up for man-made fibers, which over the year ending last September had shown a sizeable price advance that was quickly reversed in October by a better-than-4-percent drop. This downtrend should continue on a combination of slow demand, excess capacity and sharply lower petrochemical feedstock costs. At this stage, man-made tabs for 2009 could even show a modest decline, especially if petroleum costs remain depressed.

Labor also seems to be pretty much under control. Falling general inflation and high unemployment should preclude anything more than another 3-percent pay hike. And, an increase of this size should easily be offset by continuing worker productivity gains, which, according to the National Council of Textile Organizations (NCTO), has over the last 10 years increased 50 percent - the equivalent of a 4-percent annual gain.

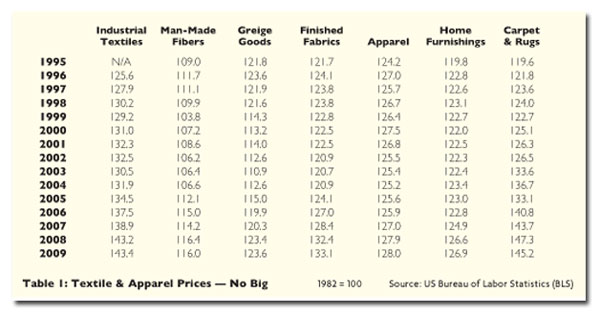

Nor is this productivity factor likely to diminish any time soon, primarily because of continuing investments in new, more efficient mills and equipment. In 2006, the latest year for which solid figures are available, US mills spent more than $1 billion to upgrade and make their facilities more competitive. And preliminary estimates suggest a similar amount of investment for 2007. While 2008 probably showed some slippage in these outlays, it was probably not nearly enough for any appreciable slowdown in overall efficiency. As such, TW expects textile and apparel productivity to continue advancing by at least 2 to 3 percent through 2009 and for the first few years of the following decade.

Prices Remain Steady

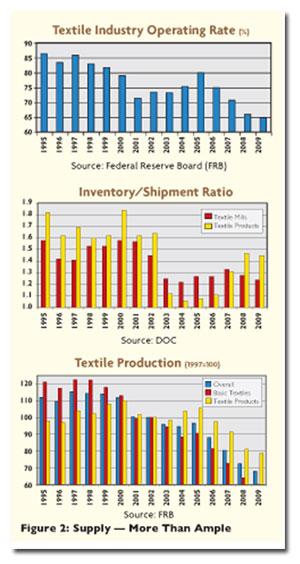

Also, despite the current market downturn, the industry's prices haven't been weakening all that much. At last report, producer tags on basic and more highly fabricated textile mill products were running fractionally above year-ago levels (See Table 1). Latest prices for greige goods, finished fabrics, industrial textiles and apparel managed small gains of 0.9 percent, 0.9 percent, 0.8 percent and 0.6 percent, respectively - all in sharp contrast to quotes in other consumer-oriented lines, like autos, where prices have been heavily discounted over recent months.

Nor have textile/apparel prices performed too badly when compared to the "all soft goods" producer price index, which, excluding food, recently has tended to weaken a bit. To be sure, textile and apparel tags aren't about to set any new records in 2009, and spotty declines can't be ruled out. But there are no signs of any meaningful drop, largely because the price advantage of our major competitors has been narrowing.

One exception to the overall price trend is carpets. With housing down, prices of these products could well dip into negative territory over 2009.

Looking further into the future, TW sees a basically flat-to-slightly-higher pattern returning in all major subgroups by 2010, assuming the economy picks up as expected.

A Still-Profitable Industry

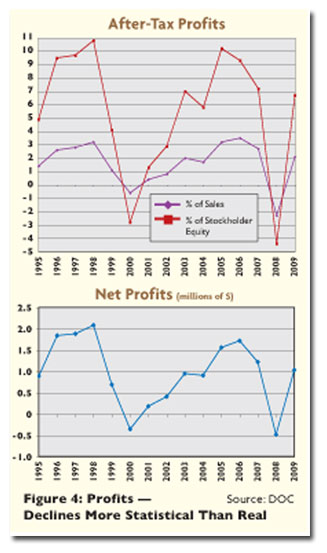

Despite today's strongly negative business climate, mills and apparel makers have managed to remain in the black. Much of the credit has to go to industry executives who have been able to keep costs down and prices on a relatively even keel. True, earnings have slipped in recent quarters. But much of the decline may be more statistical than real.

In the third quarter 2008, for example, the government's after-tax profit number turned negative, but on closer examination, it appears the fall-off was due primarily to a one-shot big jump in non-operating expenses. Look at net income from mill operations, and the earnings number is still positive - not much below the previous quarter and only moderately under the year-earlier reading.

Given the aforementioned non-operational expense charge, a similar trend shows up in overall 2008 earnings performance - negative overall profits, but positive operational profits. The same is true of after-tax margins also shown in the forecast tables (See Figure 4). TW estimates overall 2008 profit/sales and profit-per-dollar-of-stockholders-equity ratios dropped into the red. And again, the figures turn positive if one looks at margins based on operating performance.

This latter conclusion is backed up by Global Insight analysts' projections using a profit measure based on mill operations - shipments less labor and material costs. The consulting firm suggests 2008 after-tax profits of $4.8 billion and $8.4 billion for basic mill and fabricated mill products, respectively. True, Global Insight anticipates some erosion for 2009, though it sees the industry again remaining solidly in the black as far as operating profits are concerned.

And some brightening is anticipated for 2010, when the earnings curve is expected to bottom out. Moreover, look ahead to 2011 and 2012, and the numbers could show some fractional gains.

Employment Numbers Still Fall

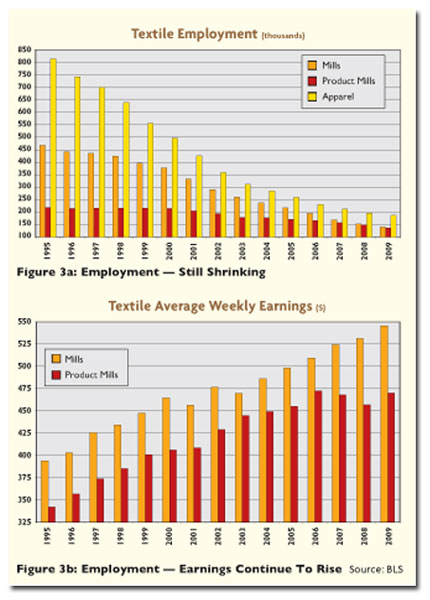

On a less rosy note, the number of textile/apparel workers continues to tumble. Over the past year, overall mill employment dropped to only 303,000 workers, less than half the total reported in 1998 (See Figure 3a). While some of the continuing decline can clearly be traced to reduced demand, another big part reflects the fact that each worker is now turning out a lot more product than his or her counterpart a few years back.

Expressed somewhat differently, two forces are putting strong downward pressure on employment - shrinking activity and rising productivity. The latter has helped keep unit labor costs relatively flat in the face of slowly rising worker pay levels (See Figure 3b). Credit most of this rising efficiency curve to continuing heavy investment in new plant and equipment. While these expenditures are slowing down, TW regards this as temporary and sees capital outlays returning to previous levels by 2010.

Another implication to continuing capital spending: In addition to improving mill efficiency, it adds capacity to an already glutted marketplace. Despite all the plant closings in recent years, textile mills at last report were operating at only around 63 percent of their potential. Other things being equal, this translates into an even more competitive marketplace.

More Trade Questions

Perhaps the biggest uncertainty of the new year, aside from the economy, is how imports will fare. The answer depends on a lot of variables, many of which are not under our control.

One of the most important unknowns here is how Beijing's currency fares. At this point, the feeling is that further upward revaluation is highly unlikely. That's a major shift from the past few years when an increasingly valued yuan helped to level the global trade playing field. Behind this likely change: China, hit by its own business slowdown and rising costs, has seen its exports begin to slow down, thus increasing pressure for a lower-valued yuan that could revive export demand. The latest Chinese statistics certainly seem to explain this new strategy. Over the first half of 2008, some 10,000 textile and garment factories were forced to shut down, leading to rising unemployment and social unrest. It's hardly the climate to continue the appreciation of the yuan, which rose 21 percent from mid-2005 to mid-2008.

Despite this changing climate, it is doubtful whether any sharp yuan downturn would be politically feasible. Any sustained drop in the Beijing currency would almost surely cause an uproar in Washington, where the Obama administration has signaled it wants a strong Chinese currency - both to keep US imports under control and to reduce the cost of US products to Chinese consumers.

NCTO also is adding its voice on the need to put a ceiling on Chinese exports, and the currency problem isn't its only concern. Equally important is the question of Chinese subsidies, which recently have been increasing. NCTO spokesmen say Beijing subsidies have risen from 11 percent last summer up to near 17 percent now - an increase of 55 percent, or $10 billion, to a total of $29 billion.

The US industry also is becoming worried by a shift in Chinese marketing strategy aimed at upgrading their offerings. More and more Chinese companies, from yarn and fabric mills to garment makers, are striving to break into high-end products at prices well under those of Western competitors.

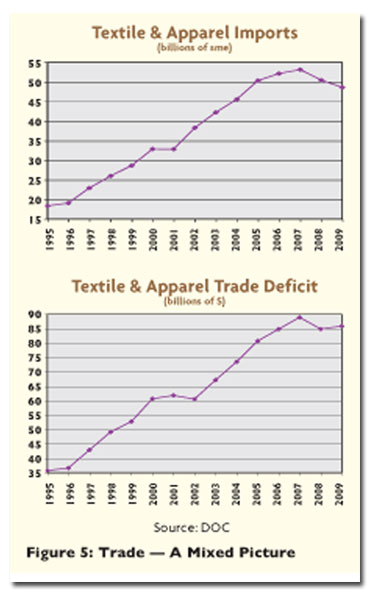

How all these trade imponderables play out over the new year is still not entirely clear. The big question is whether the United States can hold the line on imports as well as it did last year, when overall textile and apparel incoming shipments on a square-meter-equivalents basis dropped about 4 to 5 percent (See Figure 5). The answer, assuming Washington means what it says about preventing another surge, is probably "yes." TW 's estimate for 2009 calls for about another 3- to 4-percent decline in imports, primarily because of lower consumer demand. But demand for domestically produced goods will probably fall by about the same amount. As such, don't look for any real improvement in the domestic producer share of the overall US textile and apparel market.

Finally, there's the trade deficit. Given the fact that US exporters of mill and apparel products face new problems because of the economic downturn in other countries and a strengthening trade-weighted dollar, it looks like the trade imbalance could grow this year to near $86 billion, reversing the slight improvement noted over the past year.

Industry Innovations Help

Meantime, US firms continue to be increasingly proactive in keeping their mills and factories afloat, turning out more new and improved products that are helping to spur demand even in today's difficult times. Probably the most important is the still-steady stream of new fibers and fabrics. As one mill executive put it: "We want to develop state-of-the-art know-how that cannot be found in Asia and elsewhere. Our purpose is to create new, profitable markets."

In the fiber sector, better performance and value are the goals - with both natural and man-made types reporting new breakthroughs. In cotton, for example, new TransDRY™ offerings developed by Cotton Incorporated provide users with the fiber's familiar comfort and softness while at the same time allowing the wearer to stay drier and cooler.

Upgraded polyester products are lighter, thinner and more delicate. New polyester creations costing upwards of $1,000 are beginning to show up in upscale stores. Small-volume fibers also are coming up with improvements covering the gamut of desired qualities including improved washability, color, thermal insulation, fire resistance, stretch, moisture management and antibacterial protection.

Such innovative thinking has even spread to traditional fabrics like denim. New offerings here include wool blends, double-sided fabrics and greater use of organic cotton. There also are more multi-layered finishes in which elements such as weft color are combined with dyes or coated resins to provide new opportunities to customize.

The growing introductions of high-tech products also are playing an ever-growing role in opening up new opportunities - for example: smooth new microfiber underwear; and a new breed of battery-powered outerwear that heats up the body with the press of a button and eliminates the need to layer a bunch of bulky items.

Moreover, these are only the tip of the high-tech iceberg. Also making substantial marketing inroads are performance-enhancing sports apparel products that basically are designed to improve muscle strength, aid circulation and improve flexibility. Two examples here: new garments with built-in bands to add muscular support; and swimsuits designed to help swimmers zip through the water. One company even claims to have clothes that hasten muscle recovery after extreme exertion.

Nor can style innovations be ignored. Levi Strauss & Co. says its new Totally Slimming jeans flatten figures and spare women from having to manipulate their belts to keep their jeans snug. The jeans' high-stretch fabric shapes the leg and "lifts" the bottom. There's a hidden front panel for tummy control.

Even relatively small markets are being explored. Take new bullet-protection clothes that are astronomically high-priced, but for those who must and can afford to have such protection, they remain extremely attractive.

Nonwovens aren't being forgotten either. Recently released polymer-based products consisting of a broad area of engineered fibers are focusing in on such growing market areas as medical/hygiene, filtration, wipes, automotive, industrial and interlining.

Ecology's Expanding Role

Catering to environmental demands also is becoming increasingly important for keeping the industry's mills and factories humming. The emphasis on "green" applies to the whole spectrum, from basic fibers all the way to finished garments.

Starting with fibers, cotton, in an effort to widen its appeal, is now adding the word "natural" on the packaging of 100-percent cotton products. The trademark is intended to remind eco-conscious buyers that the fiber not only is natural, but over the past 25 years has reduced its environmental footprint by making major reductions in the use of pesticides and water.

Even wool is jumping on the green bandwagon, and now offers cashmere from goats raised in sustainable herds, rather than from the Inner Mongolian area where grazing has severely eroded the land.

Other new and improved organic materials also are attracting more attention. Bamboo is a classic example. It grows rapidly, uses little water and no pesticides, can be harvested every three to four years and breaks down in landfills. Other increasingly popular eco-friendly fibers include those made from soybeans, corn, hemp and even banana leaves.

Nor are recycled fibers being ignored. Materials entering the market include polyester made from plastic bottles and recycled polyester blended with cotton, bamboo and soy.

Further downstream, clothing manufacturers are increasingly touting organic fibers and vegetable dyes. Result: Trendy "greenies" now can dress up in a wide array of attractive eco-textiles.

In short, sustainable fashion is in. A survey by Cotton Incorporated finds that more than 50 percent of consumers now say they are putting at least some effort into looking for environmentally-friendly clothing.

Retailers also are in the forefront of the eco drive. Their basic message to suppliers these days: If you don't follow some ecological principles, we will look for other suppliers who can and will.

One final sign that reducing the environmental footprint is now mainstream: The increasing reliance on third-party certifications. At last count, there were 38 certifiers for textiles. These include such organizations as the International Oeko-Tex Association, bluesign technologies ag and the International Working Group on Global Organic Textile Standard. Some of these outfits even work with manufacturers in such key areas as water use, energy and chemicals.

Other Strategies Also Help

US producers and distributors also are using better logistics management to improve their competitive positions. On the retail front, major chains are fine-tuning their ordering, thus helping them stock just enough of the hottest styles for today's increasingly fickle and tight-fisted consumers. Thanks to software advances, they are able to order the latest styles weeks and even months faster than before. According to store executives, efficient logistics has now become the crucial element of overall production and marketing strategies.

Rather than relying on the old phone-and-fax approach to placing big orders, the industry is increasingly applying sophisticated software to the problem. The end result is better planning all the way from the designer to the retail outlet. One chain spokesman says this new approach has permitted his firm to shrink the cycle - all the way from when a style was just a gleam in a designer's eye to a finished item in his stores - from about one year to around seven months.

Topping this, the Zara chain claims that by maintaining an iron grip on every link of its supply chain, it can move designs from the sketch pad to the store rack in as little as two weeks.

Better decisions on where to source also can improve bottom-line performance. It often makes sense to produce domestically despite the fact that some 90 percent of the clothes Americans buy comes from places like China, Mexico and Bangladesh.

Brooks Brothers, for example, prefers to make its ties in the United States. According to a company executive, there are real advantages to having your factory in your backyard - from being able to test new fabrics and make changes quickly to fostering collaboration with suppliers on innovations like stain resistance to having a handy place to iron and repackage ties on their way to outlet stores.

Another strategy, aimed at whetting consumer appetites, is the attempt at upgrading sizing standards. According to the NPD Group Inc., 84 percent of women have issues with the fit of apparel, and more than half have trouble finding garments that fit. New sizing systems geared to today's real body shapes are now being used by such large outfits as QVC, Nordstrom and Macy's. If this trend really takes hold, it also could cut down on store returns, which this past year grew 23 percent in value to $219 billion.

Halting Illegal Activity

Meantime, today's dog-eat-dog markets also are making industry policing a lot more crucial. This involves not only the need to battle counterfeiting, but also the blocking of illegal shipments from abroad.

Looking at counterfeiting: Some 15 percent of US shipments seized by US Customs in 2007 consisted of apparel, and 40 percent were attributed to footwear. Most of these products came from China, which at last report accounted for 80 percent of all seizures. Making this policing especially difficult is the increasing technological sophistication, which more and more is facilitating simple and low-cost duplication of copyrighted products. To counter this problem, domestic firms are turning to a series of deterrents, including the staffing of dedicated anti-counterfeiting departments, checking the Web for replicas of their particular products and seeking third-party help.

There's one third-party firm, ARmark Authentication Technologies LLC, whose security fibers and yarns containing proprietary information can be stitched or woven into a garment. To see this information, a high-end optical device is required.

As for the role of Uncle Sam in preventing illegal trade practices, Washington now is allowing anti-subsidy cases to be filed against non-market economies. And there's been a sizeable step-up in pursuing countervailing duties against some incoming products.

Also, the USDA is providing assistance to textile manufacturers that invest in capital improvements by acquiring, constructing, installing, modernizing, developing, converting or expanding land, buildings, equipment facilities or machinery. Payments under the program are based on the amount of cotton consumed by the applicant (See " Cotton Funding Promotes Investment," this issue).

National Cotton Council (NCC) Chairman Larry McClendon adds that given the intense competition in the worldwide textile and apparel market, it is appropriate for Uncle Sam to help US textile firms take steps to enhance their efficiency and improve their competitiveness.

NCTO officials also are adding their weight to assure more fairness in the drive to keep a lid on Chinese incoming shipments by insisting on new and more efficient safeguards. They argue that US textile manufacturers are among the most competitive in the world, but they cannot compete with countries like China that both engage in predatory trade practices and benefit from illegal subsidies.

NCTO and NCC are supported by other trade organizations including the American Manufacturing Trade Action Coalition, the National Textile Association, the US Industrial Fabrics Institute, UNITE HERE and the American Sheep Industry Association.

A Summing Up

While domestic and global economic problems will continue to buffet mills and apparel makers, their overall prognosis isn't really all that bleak. The industry will weather the current economic downturn and should be on its way to bouncing back once the economy recovers.

That's not to say the losses of the past decade will ever be recouped. But the industry - given the recent consolidations, global partnerships and willingness to continue investing - is now leaner and meaner, and able to respond a lot more quickly and decisively to changing market conditions.

If there's any doubt about the domestic industry's ability to compete in today's one-world market, look at its continuing productivity gains. Over the past decade, efficiency has increased 50 percent - the second-highest rate among all US industrial sectors. Moreover, despite all the recent shrinkage, the US textile and apparel sector continues to rank high in terms of shipments - nearly $90 billion this past year. And the same is true of its exports to the rest of the world, where the United States is still the third-largest exporter of these products.

Nor is TW alone in expressing long-term optimism. Global Insight now sees steady to even higher industry activity possible as soon as 2011.

In the words of one top textile executive: "We're surviving the current downturn a heck of a lot better then many other domestic industries. Come back in another 10 years and we will still be here - still a major player in world markets."

January/February 2009

Source - www.textileworld.com

No comments:

Post a Comment